Cash Credit Account Not ‘Property’ for Attachment Under Section 83 Bombay High Court

DEMAND STAYED DUE TO CONSOLIDATED NOTICES-GST LAW

Order cancelling GST Regsitration quashed

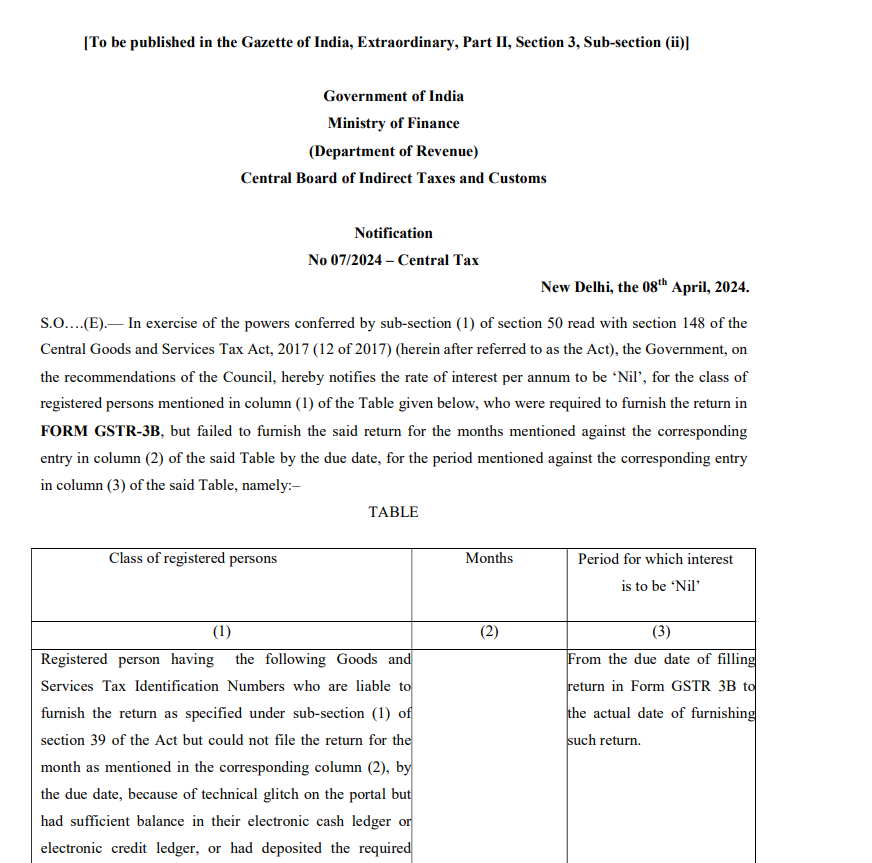

Central goods and services tax Act, 2017 25.06.2024 (1)

CBIC GUIDELINES FOR SEARCH UNDER GST